E-commerce startups seem like a really popular thing these days. Now plenty of people can tell you how to set up a great site, but there are two things any e-commerce site needs: a payment gateway and a working search function.

Search hasn’t been solved yet. As of the time of writing, Ikman’s search is horrible, and everything else is only marginally better; despite efforts, most e-commerce teams tell us that they just don’t have the amount of R&D they need to come up with good search and suggestion algorithms.

We can, however, help out with the payment gateways.

What is a payment gateway?

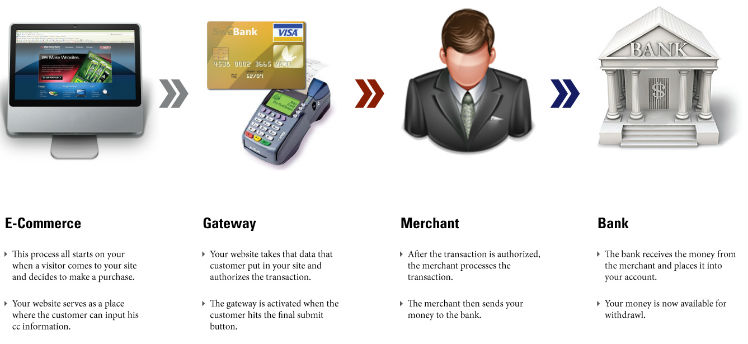

A payment gateway is something that authorizes you to take credit card payments. For an e-commerce firm, it’s the digital equivalent of one of those card-swipe machines that you get in stores. You make an SSL connection to a server somewhere, and voila, the money goes where it needs to be.

Since credit cards are issued by banks, and the payment back and forth are also handled by banks, it makes sense that payment gateways, too, are provided by banks. Unfortunately, there’s no such thing as a free lunch. There was a time when payment gateways used to be hideously expensive. Now things have gone down quite a bit, but you still have to pay. We called up a couple of banks – Seylan, Sampath, Commercial Bank and Nations Trust, HNB – for their rates, and here’s the breakdown.

ROUND ONE

1) CARDS

The first concern is: what cards does the gateway support? It’s pretty useless if you end up with a fairly rare card as opposed to the more popular Visa and Mastercard.

Thankfully, almost every bank supports all cards. Except for Nations Trust, which accepts only AMEX cards; given the fact that the majority of Sri Lankan customers run almost entirely off VISA cards, this puts NTB out of the running.

HNB also fails right here, for a very simple and entirely unrelated reason: they either don’t have payment gateways or have very poor customer support. Our call was bounced to six different people, none of whom knew what a payment gateway was (but we’re sure HNB had one), before being redirected to the right person, who, unfortunately, turned out to have taken a day off. Needless to say, this threw a spanner into the works, so we’ve had to drop HNB from the running altogether. ![]()

2) INITIAL COST (AKA THE SETUP FEE)

Every bank will charge you a fixed sum to start off with.

Commercial Bank – Rs 75,000, varying depending on need and customer – as of the time and writing, we haven’t gotten any system of predicting how this fluctuates.

Seylan Bank – Rs 20,000.

Sampath Bank – Rs 15,000.

So, as far as the initial cost goes: Sampath is clearly cheaper. Arguably, it’s not a massive gap between Sampath and Seylan, though it’s curious that such a high gap exists with Commercial Bank. Remember that NTB is out of the running due to their AMEX-only dependency.

3) GATEWAY MAINTENANCE FEE

Buying a gateway isn’t enough. Like a domain name, payment gateways come with recurring fees, usually annually.

Commercial Bank – Rs 90,000

Seylan Bank – Rs 30,000

Sampath Bank – Rs 60,000

This is a massive difference. As you can see, there are huge, 30,000-rupee gaps between the banks. Off the bat, this radically changes our assumptions of the cheapest way of doing things. Let’s do the math

| Organization | Cost of running for the first year | Cost of running for two years |

| Commercial Bank | 75,000 + 90,000 = 165,000 | 165,000 + 90,000 = 255,000 |

| Seylan Bank | 20,000 + 30,000 = 50,000 | 50,000 + 30,000 = 80,000 |

| Sampath Bank | 15,000 + 60,000 = 75,000 | 75,000 + 60,000 = 135,000 |

As you can see, the differences are huge. Why these differences exist we’re not entirely certain, but we’ll explore more factors down the line to see if we can make sense of the math or declare a clear winner. At any rate, we’ve highlighted the cheapest option (Seylan), which wins this round, in our opinion, by a huge margin. Given the rates at which the costs stack, a 5 or 10-year projection only makes Seylan look astronomically cheap compared to the competition.

| Organization | Cost of running for the third year | Cost of running for four years |

| Commercial Bank | 255,000 + 90,000 = 345,000 | 345,000 + 90,000 = 435,000 |

| Seylan Bank | 80,000 + 30,000 = 110,000 | 110,000 + 30,000 = 140,000 |

| Sampath Bank | 135,000 + 60,000 = 195,000 | 195,000 + 60,000 = 255,000 |

ROUND TWO

4) COMMISSIONS AND DEPOSITS

Now we must consider the other costs of maintaining a payment gateway, as well as the security deposit. Gateways charge a percentage of each transaction.

Both Sampath and Seylan banks charge a fixed 3% commission on each transaction. Commercial charges 4% (we were told that this varies, though the exact range is unknown).

Most banks seem to require a minimum fixed deposit of Rs 100,000, except in the case of Seylan Bank, which requires a deposit of Rs 300,000. Sadly, NTB would actually have been very useful here – no deposit needed – but they’re out of the running given that they support only AMEX.

All banks also require you to have an account at that particular bank, and once the gateway is bought and paid for, you get tech support, shared servers, and a setup time of 2-3 weeks (the exception is Commercial Bank, which promises a setup time of 1-2 weeks).

5) VERDICT

Given all of the above, we can see a fairly clear-cut choice: Seylan. While the initial fixed deposit is 3x that of other banks, the math works out overwhelmingly in its favor, especially if your business plan stretches into years. Commercial Bank’s faster setup time is to its credit, but fails to justify the high setup and higher maintenance fees. Sampath has the credit of being the cheapest to start with, but its high maintenance costs negate that advantage early on.

Extra research is always warranted, as this is a preliminary scan; in your choice, make sure to factor in service, efficiency, and technical factors – especially how much headspace the shared servers actually give you. These needs, of course, will change depending on you and your business. We’ve given you a heads-up – hopefully, this helps when making your choice.

[Update 17/09/2019]: For an updated list as of 2019, check here.

Good article. Thanks for putting this together.

I always though Sampath was the only bank with a payment gateway. Never thought Seylan would have one and that would be way better than Sampath. Seylan needs to market their products.

Commercial Bank’s IPG is hands down the easiest to implement after PayPal. Of course you gotta go back and forth to test and make it live but their support is awesome. They are fast and responsive. Have done the setup for several websites of mine already.

Mind sharing some examles?

Hi Shageevan

can we transfer Paypal credit to our saving account (HNB or Sampth)

Still It Can not be done with sri lankan paypal account

You left out HSBC’s payment gateway. Any particular reason?

HSBC technically isn’t a local bank, and we were examining only local banks for this roundup.

HSBC : “world’s local bank” though

Why aren’t there cheaper local options.., with lower initial+yearly cost and bit higher transaction cost?

Would have been great if HNB and HSBC rates were there too.

HNB unfortunately didn’t seem to be able to answer the phone.

This article seems to follow on from the one from Vesess: http://vesess.com/online-payment-methods-in-sri-lanka-the-bad-and-the-ugly/ – local payment gateways have lowered their barriers to entry, but they’re still a major pain to integrate, and look plain horrible.

Earlier today I made a purchase at mystore.lk, and the Combank gateway interface actually looked rather presentable, to my great surprise. Perhaps something to do with their partnership with Paycorp from Australia.

Selyan—which you recommend—uses the same (Indian?) company as Sampath. They’re cheaper but win no awards in the looks department. The checkout workflow feels as if you’re being scammed. The URL has nothing to do with the merchant or the bank (anyone can throw a logo on a checkout page – that doesn’t count). This could be avoided by clearer explanations at the very beginning about the domains the customer would be redirected to, and having some sort of extended validation.

Contrast this with the likes of Stripe. Okay, that might be asking to much, but surely we can do better than this.

Thanks for the feedback, Vimukti. Yes, UX in this regard is a subject which deserves a discussion of its own.

I’ve done business with HSBC. It’s very hard to deal with them and they require 2 years audited accounts. Not recommended for a startup also their fees etc were way higher. Sampath and Seylan payment interface is crappy and is not mobile friendly as well. Well end of the day all boils down to payments….

Cheers to Seylan-the bank with a heart. Infact, Seylan has a dedicative eCommerce department & they were offering IPG services with best rates since a decade. Unfortunately, their marketing is so poor in this regard.

Banks need to offer attractive rates to meet future payment revolutions based on mobile phones.

These days I’m also looking for a suitable payment gateway for my WEB site. Based on my experience I have decided to go with PAYPAL even though Commission rates are highrise. After all scenarios, I get only 86% of all money. I have to give more than 13 % to banks.

But think that they are taking 8% while sitting duck. Isn’t it unfair..?

You should try out webxpay. They offer an all in one solution very cheap option, now they have partnered with HNB.

If all the IPs doing the same thing, Why combank charge such a huge fee? Is there something wrong with Seylan IPG? Is there anyone who use the Seylan IPG. Please inbox me. ([email protected])

I’m also looking for a internet payment gateway for my WEB site. I have contacted sampath, they requires a request letter, rather than give the details. Anybody know the basic requirement to obtain a IPG from any bank?

Is Company registration must for the IPG?

What are the basic requirements to obtain a Internet payment Gateway? Do we need transaction history(4-5 years with million or billion rupees) with that bank?

Yes Company registration must for the IPGMONEY ! I guess.

I’m also searching for the best IPG and confused by the charges of the banks, especially commercials 90000/= annual fee and seylan’s 300000/= FD. And also even though I’ve heard that Paypal doesn’t supported in Sri Lanka in Paypal’s site it indicates sri lanka as a supporting country. Even though the rates are little bit higher, 2CO seems to be the solution up to now. Anyway thanks a lot for the information provided in this letter.

Integrate all Sri Lankan Banking paymwnt gateway and all system integrations,

Paycorp, MiGS, Accosa, Sentry, Infinia Sampath Vishwa net banking, HNB net Banking. z-Cash

Enpower your web bases system with monitoring and performace systems.

WSO2 EBS, WSO2 IS, Machine learner

all Bank card Support

if anyone have payment gateway with paycorp. please contact me. i have deal with 500,000 lkr profit per month. 0766723204

nishan

Anyone have a paymentgateway account please cntct 0766229822

I found this article very useful when setting up the e commerce feature on a site, the rates and details were really accurate. Thank you. I actually picked Seylan, I found their offers very useful. Maybe they could help with some of your needs as well. Check out their site: https://www.seylan.lk/ Hope it’ll be useful

Hi Radev,

Glad the article helped you 🙂

Anyone using WebXpay?

I am all gateways included Visa/MC/Amex/Sampath/vishwa/mcash/ezcash. Also linked to logistic support. Cheap and smooth option. I understand they have partnered with HNB.

Hey great article thanks!!

Do you know if there are any updates on this? (May 2017).

cheers

Any one who is using webex ? Do they operational?

Really the article was very useful since I was looking to integrate my website with payment gateway and wanted to choose a service provider. Moreover I was able to update my knowledge regarding payment gateway. I’m very glad to study the content from UD………

Obviously this is a very useful article. But, from the perspective of a customer who is trying to make payments online will love to disclose their security codes only when it is 100% secure the website. What is the assurance that can be given to the customer to establish their confidence to disclose security codes in the website?

Is the PAYPAL works with any of e-commerce site in Sri Lanka ???

Anyone who have an idea or have worked with bizpay.lk or payhere.lk IPGs? Are they legit?

Does WebExPay expect you pay their subscription all up front in one go if so that’s not pay as you go monthly that’s pay annually . Also I understand they have a WooCommerce plug in for the gateway is this correct and how long does it take to intergrate?

Additional question for Graham, I visited you site and cannot see any basic pricing structure can you give me an approximate idea of the cost to integrate a payment gateway into WP website we would obviously not be using any of the large banks far too expensive I also noticed that you have Pan Asia Bank listed we have speaking with them about opening a business account they said they don’t have a payment gateway so how do you process payments to them using which system many thanks

Hi, any way of checking the quality of the each product? True the cost would matter but shouldn’t we compare the stability of the product as well?

The article does not details on that. It would have been grate if those facts were also mentioned.

By the way what the solution the top Companies in Sri Lanka using?

Visit NCC Payment Gateway on ncc.yazhii.net

One step setup, just only Rs.1500 for any merchants to integrate electronic payments in to the business.?

OH hell.. i don’t see any payment gateway related feature in this mentioned site. This is just payment (bill payable) site. But even though it is not up-to production level. i found such a feature that able to record our expenses and incomes and find basic level analytics.

This site has both Bill payment & Payment Gateway. It is re branded to https://www.ipayos.com.

Any updates on this subject?. Because i am planning to go for e-commerce. Searching a productive payment gateway.

There is this,

http://www.readme.lk/payhere-sampath-bank-partnership/

Hi Yudhanjaya,

Any update on the latest status of IPGs in Sri Lanka?

As I saw recently Echannelling has got rid of Global Pay and Combank has come in. Most of the leading sights seems to have Sampath’s and Combank.

Some facts I gathered in my experience which has a connection to the contents of the article.

1. Most major bank IPGs (except NTB) does not accept AMEX. This is because AMEX is a different system and NTB is the ones who used to handle AMEX. AMEX IPG is actually to be added to a current IPG not to use solely as your IPG. This is similar in EDC POS machines where NTB installs AMEX software to your current Visa Master POS machine which is issued by a totally different bank. AMEX is useful for people with foreign business like tourism related.

2. Commision vary from 3% to 4% is due to the fact whether the card is foreign or local. Foreign cards have a higher interbank fees which leads the bank to reflect the same on the merchant.

3. Merchant rates Setup fees annual fees and if a deposit is needed vary from establishment to establishment depending on their portfolio maintained at the bank.

4. HNB does have an IPG and they have in par rates.

5. Most of these fees differences are due to the internal fees involved at the bank’s end with related to bank to their partnership with a foreign system and internal fees related to bank to visa mastercard networks.

6. At times the annual and setup fee differences reflects the technology, services and customer care.

7. Local card transactions via IPG are usually smooth with almost all the IPGs. But when it comes to foreign cards (eventhough it’s visa or mastercard) isolated errors can arise depending on scenarios and circumstances. I had to give up on a leading mobile-phone attached POS machine service (around 5 years back) which was fine with local cards but it developed errors (one sided transactions where the customer card is charged but I see as declined and then customer card is refunded at the end of the month) when processing foreign cards which the same card worked well in the normal EDC POS machines. However in my case they refunded all my joining and annual fees and they no longer advertise their mobile phone products as foreign card friendly.

8. To request an IPG you need a valid business registration in sri lanka and also a merchant account (merchant ID) and preferably a current account in the relavant bank. If you are a new customer to the bank then they will request your accounts because there are risks involved in the credit card technology (like chargebacks) where bank should be able to satisfy that bank-side risk is low. If you are a ongoing customer at your bank then they will look in to your portfolio / accounts at bank and may give a green light.

Hi,

What are the differences between paypal PG and our local PG’s

How about payment gateways like PayHere? How do they operate?

https://www.payhere.lk

They do now 😉

http://www.readme.lk/payhere-lankan-payment-gateway-returns/

Hi

The research on Payment Gateways was published in 2015. Do you have a update?

Also if it is a global platform do the banks in Sri Lanka provide USD account?

What about foreign banks like HSBC ?

Hi Yudhanjaya,

Any update on the latest status of IPGs in Sri Lanka?

As I saw recently Echannelling has got rid of Global Pay and Combank has come in. Most of the leading sights seems to have Sampath’s and Combank.

I saw recently payable guys have come up with a great product which could connect to the smartphone via Bluetooth. It’s pretty handy and Seema to be catching the market. Any idea on this guys?

This was the most recent article we did on them. Hope you find it helpful 🙂

http://www.readme.lk/payable-signed-2000-new-merchants/

Gomida and Lahiru, appreciate your comments.

Hi Shageevan, I went through the comments made by you initially. Any updates?

Also any bank which supports tokanization with a stable solution?

iPayOS (https://www.ipayos.com) supports tokenization.

NCC is now re branded to iPayOS (https://www.ipayos.com). It has Payment Gateway integration with monthly rental model.

It is really cool. Integration is also very simple. Sample code is available in gitlab:

https://gitlab.com/yazhii-community/yazhii-ncc-client-demo

Additionally, utility bill payment is coming with this for free. Looking forward with good features.

Please any body give me solution to how to implement seylan bank ipg with my asp.net website?

thanks for the information. Im making a e commerce site for my work place I havn’t any idea wht to do now. gateway fees are not fair. by the way Thanks again

Very good article, I spend a long time to find above details

Very useful article…Thanks for sharing!…

Great article. Can you please do an update.

Also great if you can do a article on payment companies in SRI lanka and their features and user friendlyness

Yes. High time we did an updated piece.

Hi Prabodha,

You can find our update on IPGs here (2019): https://www.readme.lk/internet-payment-gateways-in-sri-lanka-2019/

Great piece of work. Can we expect a latest comparison with the features as card on file/tokenization also availability at its best.