Last week, we saw Bhasha introduce a digital wallet that lets you pay with your fingerprint. Now, the Central Bank of Sri Lanka will be kicking off its national rollout for LankaQR, its national QR-based payment platform. Titled, “LankaQR ජනගතකරණය (‘janagathakaranaya’)”, the program will officially begin its nationwide campaign.

LankaQR is an initiative by the CBSL, together with LankaClear and other financial institutions, that has been in the works for years. The idea is simple. Users will have a payment app that supports LankaQR and merchants will have a corresponding QR code that lets you scan and make instant payments. Following a successful payment, the app gets updated, and the user receives an SMS confirmation.

The project is an ambitious effort to push for a cashless economy in Sri Lanka. However, this isn’t the first time there was a national initiative for LankaQR. Back in 2020, the CBSL launched a campaign titled, “රට පුරාම (‘Rata Puraama’) LANKAQR”. The campaign prompted LankaQR-certified banks and other financial institutions to open branches island-wide to onboard new merchants.

The feasibility of it all

The 2021 campaign launches at a time where society is increasingly moving towards more convenient cashless payment solutions. Amidst a pandemic-affected landscape, paying via QR codes is not only contactless but also much faster compared to swiping your card details. At least in theory.

On the topic of payment cards, it’s reported that some local banks are currently struggling to issue new payment cards. The global microchip supply shortage is preventing manufacturers from producing new payment cards. The Smart Payment Association indicates this shortage may continue for another year.

As such, it feels like an apt time for such a QR-based payment platform to scale at a national level. But as with most new digital solutions, mass-scale adoption is often tricky. One way of going about it is through lower fees. According to 2019 circular pertaining to QR standards for local payments, the maximum Merchant Discount Rate was at 0.5% throughout 2020. Additionally, payments to government services via LankaQR were free of charge during the same period.

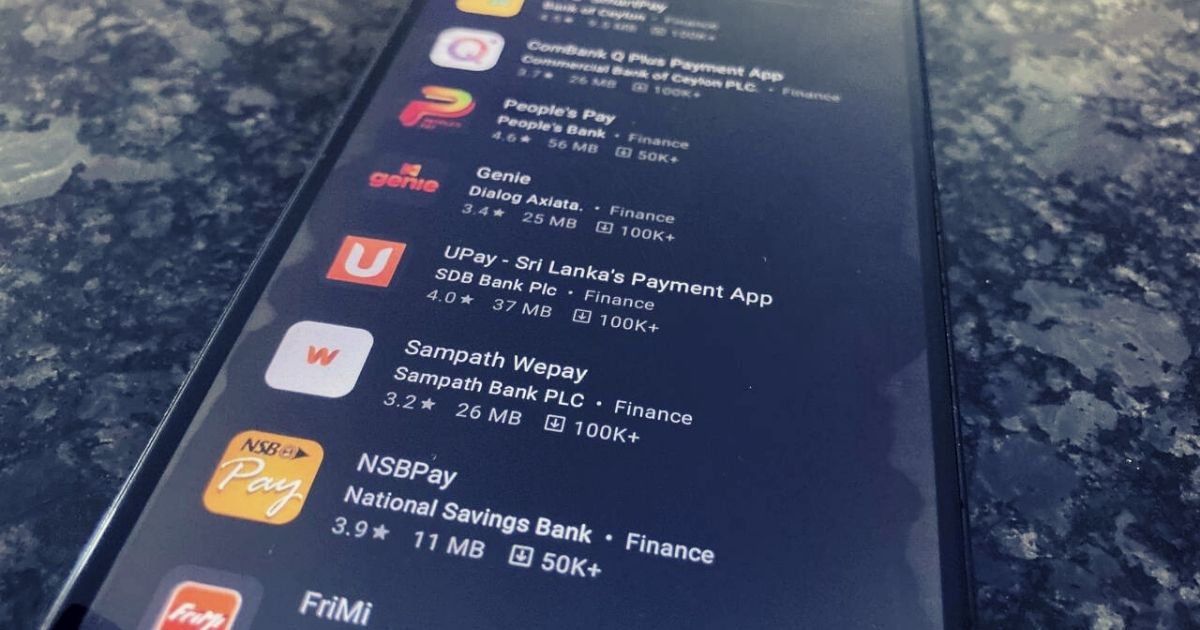

But enticing merchants is only one part of the equation. If such a platform is to extend beyond the usual early adopters and tech enthusiasts, better accessibility needs to be facilitated. At present, almost every bank, financial institute, and even every major payment app are already LankaQR compliant. While this helps with accessibility to an extent, the sheer number of apps alone might not work in its favor. According to LankaClear, there are currently over 20 mobile apps that support LankaQR. Mind you this is in addition to some of the standard mobile banking apps.

Challenges

Then there’s the cash problem. Even with the plethora of digital products and services in place, cash continues to reign supreme in Sri Lanka. So, for the island nation to truly adopt cashless alternatives, cash should be the less convenient option. This doesn’t just mean being able to pay for a service in a matter of seconds. It also refers to how opportune cashless solutions are for different communities.

Take taxi drivers for instance. Even today it’s not uncommon for Uber and PickMe drivers to refuse card payment hires. Why? Because card payments are only a one-sided convenience - the user. Likewise, not everyone may perceive a national QR-based payment platform in the same light. At least during the initial stages.

Another piece of the puzzle for better adoption relies on device affordability. Yes, more Sri Lankans have been going digital owing to the pandemic. But issues around internet and handset affordability may trickle down to the LankaQR initiative as well. Access to affordable 4G smartphones is increasingly becoming an expensive endeavor for some Lankans.

All in all, a nationwide initiative of this nature will only go so far as to how effectively we can bring financial inclusion to the grass-root communities. The idea is that even the poorest parts of the country shouldn’t be deprived of modern financial services.

For now, LankaQR is shaping up to be a promising solution in the making. As to how soon QR-based payments will be the norm in Sri Lanka, only time will tell.

GIPHY App Key not set. Please check settings