Bhasha, the company behind the famous Helakuru and PayHere services has unveiled its latest product. Dubbed HelaPay, it’s Sri Lanka’s own version of a digital wallet platform, akin to Google Pay/Apple Pay/AliPay. The official announcement was made in celebration of Bhasha’s 10-year anniversary.

How does it work?

The basic idea is to enable convenient and faster mobile payment options. This could be something as simple as a fingerprint tap or a Face ID scan. Although the likes of Google Pay and Apple Pay exist, the unavailability in the Sri Lankan market means that such easy payment options are only but a distant reality. HelaPay aims to offer its own native solution to this problem.

In order for HelaPay to work, you would first need to connect your bank account to the service. You can do so via an OTP verification. Following this, you need to set up your biometrics, namely, fingerprint and/or Face ID.

Using HelaPay

If you’re among the millions of Helakuru users in Sri Lanka, you should see the feature listed under the “services” tab. Approved by the Central Bank of Sri Lanka, HelaPay will be available on the PayHere platform by default. This means that whenever you make an online payment via PayHere, you have the option of using HelaPay. If it’s on the mobile, you just need to tap your fingerprint or log your Face ID. On the desktop, this will be a QR code. Here, you would need to scan the QR code on your mobile.

Regardless of mobile or desktop, you will be redirected to HelaPay on your Helakuru app and you should be able to complete payments within seconds. It’s a much convenient alternative considering you won’t need to type in your card details every time you make an online payment.

Speaking to ReadMe, Dhanika Perera, CEO at Bhasha mentions, “All our PayHere Merchants have now been enabled to accept HelaPay payments. If any Merchant wishes to accept payments through HelaPay, they just need to sign up with PayHere. However, they have the capability to choose whether to accept only HelaPay payments through PayHere, or all the methods that PayHere supports.”

Building on a growing userbase

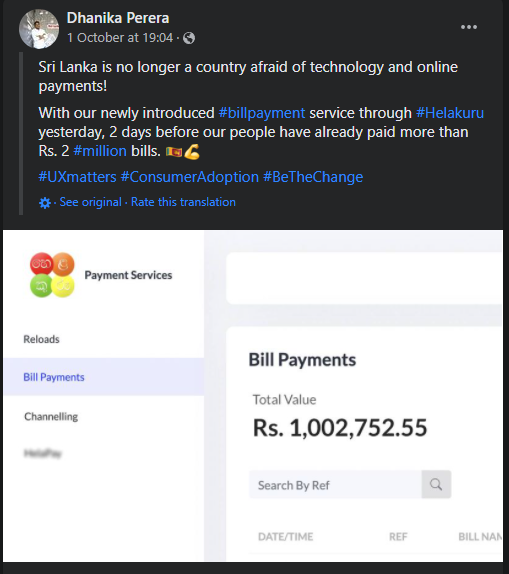

HelaPay is only the latest product to be introduced by the Bhasha team. From Helakuru and PayHere to HelaPay, the company has come a long way since its early days. Back in 2018, Dhanika shared his ambitions of turning Helakuru beyond a keyboard app. Today, there are thousands using its reload feature, amounting to over LKR 40 million monthly transactions. A more recent Helakuru feature, bill payments, accounted for over LKR 1 million within two days of launch.

It’s a clear indication that the adoption of digital solutions will show promise as long as the problems are addressed effectively. Bhasha is banking on this to make HelaPay work for the masses.

But perhaps what’s more interesting is how this new service is integrated into Bhasha’s existing portfolio. For HelaPay to work, both Helakuru (user) and PayHere (merchant) need to be in use. With a user base of over 10 million for Helakuru and 3200+ businesses on PayHere, that might not be a problem for Bhasha.

It’s a digital ecosystem in the making, one that would be primed to offer a distinct advantage as a package rather than a single product.

As to how HelaPay will be received in the Sri Lankan market, time will tell. But one thing’s clear. It certainly fills a much-needed gap in Sri Lanka’s fintech solution space.

If you’d like to know more about HelaPay, check out our review here.

Note: Article has been updated with comments from Bhasha CEO Dhanika Perera. Added link to app review

Super