The Commission On Public Accounts (COPA) recently made several proposals regarding the Inland Revenue Department’s tax collection system. According to COPA, the department’s Revenue Administration Management Information System, or RAMIS for short, currently doesn’t function properly. The proposals suggest that RAMIS would need to be updated properly in order to improve the IRD’s efficiency.

Back in 2014, the IRD under the Ministry of Finance, invested LKR 10 billion towards building RAMIS. The idea was to modernize and improve the tax collection process. However, it’s now revealed that the system doesn’t operate as intended, despite the fact that “more money has already been spent to strengthen this system,” according to COPA Chairman Kabir Hashim.

The IRD officials claim that RAMIS would need to be updated following the 2017 Inland Revenue Act as RAMIS was implemented in 2014. However, back in 2018, the IRD stated the system was being updated to include the 2017 act. The officials further mentioned that they are unable to provide contractual information as per the terms and conditions of the agreement with the company that built RAMIS, a Singaporean firm. Further, since the agreement is technically between the two governments, “intervention of the government (SL) will be appropriate for its future activities,” the officials points out.

The Singapore partnership

Prior to RAMIS, Sri Lanka’s taxation system was only partially automated and it was one riddled with issues, according to the then Senior Commissioner of Inland Revenue, B.A.D.D. Herath. “Our collected revenue didn’t match the GDP, and the figures were very low compared to other countries. Moreover, the amount was decreasing each year. So it was an urgent matter that we had to look into,” stated Herath at the time.

RAMIS was built as part of an agreement between Sri Lanka’s Ministry of Finance and NCS, a subsidiary of Singapore’s Singtel. A customized version of Singapore’s own IRAS application, the arrangement also included “change management and transformation” training sessions for IRD staff as part of the implementation process. These sessions were carried out in 2013 via the Singapore e-Government Leadership Centre at NUS-ISS over the course of three years.

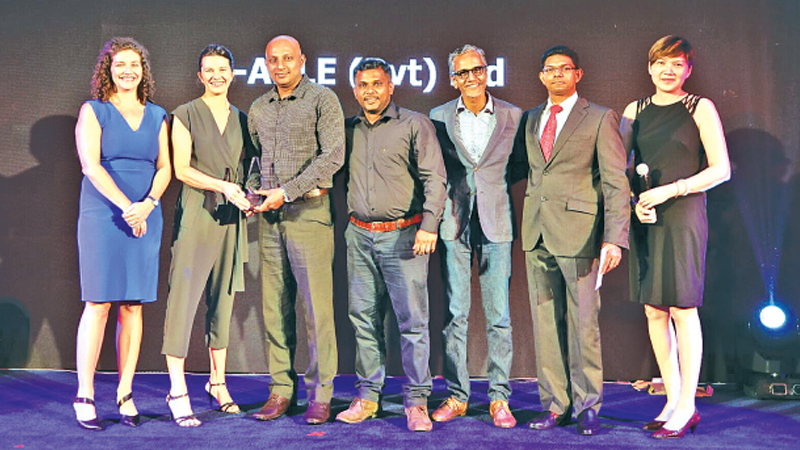

Alongside NCS, Sri Lanka’s N*able also came on board as an infrastructure architect for the RAMIS project. The company operated as NCS’s technology partner throughout its development lifecycle. Following the implementation, N*able continued to operate as the system’s customer support center.

RAMIS: Hit and a miss?

Early reports indicate that RAMIS proved advantageous to IRD’s processes, having interfaced with over 30 other state institutions. Herath claimed that the previous system would take weeks to access information for policy decisions, as opposed to real-time data on RAMIS. Revenue collection itself reportedly rose following the new system. In 2016, tax revenue collection amounted to LKR 641,547, an edge up of 14.47% year on year. Though it didn’t take long until complaints started piling up. One Sunday Times report offers a glimpse into the numerous data entry errors and breakdowns that have morphed into a problematic situation for the taxpayers and the IRD.

According to the report, a senior commissioner alleges that RAMIS failed to incorporate the 2017 Inland Revenue Act, and that prompted officials to revert to the manual system at the time (2019). The senior commissioner further claims that the handling of the system at IRD was tasked with officers who “aren’t computer savvy and deemed incompetent.” One of the reasons for the system’s regular breakdowns was due to these officers handling the system without the consent or the support of NCS. Reportedly, system changes to RAMIS couldn’t be made without NCS’s consent as the company owned the source code of the system.

Similar sentiments were echoed by Prof. Mick Moore back in August 2022. As per the professor, new IRD recruitments do not come with accountancy qualifications nor does the department have a dedicated IT team. “They depend on a range of odd people to try and fix their IT problems,” he stated. Incidentally, one would question the realized outcome of the extensive training programs with the Singapore e-Government Leadership Centre prior to deploying RAMIS all those years ago.

RAMIS and COPA

It should be noted that issues with RAMIS have already been brought up to COPA on several occasions. Back in November 2022, COPA disclosed that the total amount of arrears of taxes, penalties, and interest owed to IRD as of June 30, 2022, amounted to LKR 773 billion. Out of this, LKR 201 billion was collectible without any legal concerns, as per COPA. However, when questioned on the IRD’s failure to collect the due revenue, one of the fingers was pointed at RAMIS.

Here, the Auditor General also raised his concerns with RAMIS, particularly considering the LKR 10 billion investment and the continuous failure of the system. He further stated that despite bringing this up with COPA multiple times before, no formal steps were taken on addressing the problem.

The sub-committees

Following the problematic situation with Sri Lanka’s tax collection system, COPA proposed the appointment of two subcommittees to investigate the possibility of bringing RAMIS to operational capacity. Accordingly, one committee is to be established by the Attorney General under the leadership of the Secretary of the Ministry of Finance. This would look into the legal conditions with regard to the agreement with NCS. The other committee will comprise of the University of Moratuwa, ICTA, IRD, and the Ministry of Finance. The second committee is to look into the possibility of updating the existing system. The reports from these findings are to be submitted to COPA within six weeks.

Interestingly, COPA itself previously criticized ICTA’s lack of involvement and performance on several state projects, including RAMIS. Then COPA Chairman Lasantha Alagiyawanna mentioned that the ICTA doesn’t intervene or provide assistance to government institutions, particularly when these institutions lack technical expertise around digital projects. He added that the responsibility of equipping government bodies with tech lies with the ICTA.

Of course, this isn’t the first incident of a malfunctioning government system with a massive bill. In June 2022, the COPE revealed that the Medical Supplies Division had paid LKR 644 million for software that didn’t work. Similarly, when inquired about the possibility of upgrading the existing system, SPD/MSD officials claimed the cost would amount to LKR 7 billion.

Unrealized expectations

As of now, it’s unclear how the LKR 10 billion system will get revamped to become operationally feasible for daily use. Issues around the tax collection system have been in the spotlight over the past few years. Even the 2022 budget proposal specified a full implementation of RAMIS within the year. This was followed by the interim budget 2022 reading where a proposal indicated that all government authorities should include online revenue collection by the end of 2022. Though it appears the process is yet to be completed, if at all.

Whether these recent COPA revelations will amount to any actionable progress, only time will tell. In any case, it would be interesting to see how the IRD processes will change, especially considering the recent updates to the tax rates in the country. The IRD’s target of a 69% increase in tax income may prove to be problematic for revenue collection with the present state of RAMIS.

GIPHY App Key not set. Please check settings