It’s been a while since we wrote about Internet Payment Gateways in Sri Lanka. Well, four years to be exact. So how have things changed since then? Without further ado, here’s what you need to know.

It’s still a bank’s best-kept secret

It’s 2019. But somehow, it feels like the Sri Lankan banks are at least a decade behind. I mean sure, most of the banks today are pushing hard on their “revolutionary” banking apps or other related mobile solutions. Heck, we’ve written about quite a few of them too. But if you want to know how much an IPG will cost you, sorry you have to call them for that. Because simply laying out the prices on the bank websites for customers is too much to ask.

I wish it was just as simple as a phone call away. Most of the time you end up talking to a customer service representative, who will either revert you to the relevant department or give you a direct number to call. They would probably share the general information over the phone. But there are times the banks insist you email them with all your details first. Bit of an unnecessary headache, particularly if you just want to look for options. Not off to a great start, are we?

Nevertheless, we’ve updated the list

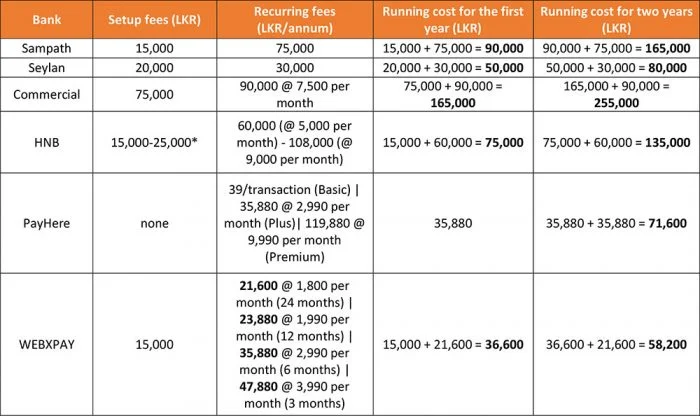

PayHere and WEBXPAY are non-bank payment gateway service providers. Both PayHere and WEBXPAY have partnered with Sampath Bank and HNB respectively as per CBSL regulations.

You might have noticed there’s quite a massive difference in the charges, particularly the recurring fees. If you take a closer look at how the costs will affect you exactly, you’re bound to get some interesting results

Additionally, the banks will also charge a commission of every transaction you make via the IPG. Here, both Seylan Bank and HNB charge 4% of every transaction. Commercial Bank charges 4%, while Sampath Bank charges 3% – 5% depending on the business. PayHere, on the other hand, charges either 3.9%, 2.99% or 2.9% depending on the package you chose.

One other thing to note is that Seylan Bank requires an LKR 300,000 security deposit, refundable after 1 year. The other providers don’t require such deposits.

Overall User Experience

For starters, only 2 IPG providers have provided pricing details on their websites – PayHere and WEBXPAY. PayHere even has a detailed FAQ section on its website. So none of the banks score any points here.

Almost every IPG accepts all cards with the exception of Nations Trust Bank, who only accepts AMEX. Hence, why we’ve left out Nations Trust Bank in case you were wondering.

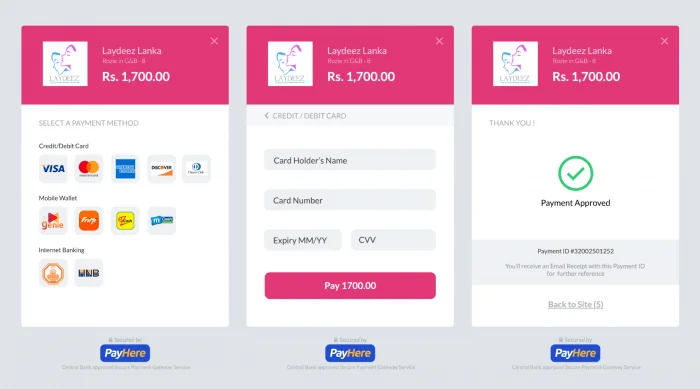

UX is a discussion topic all on its own. But if you look at the actual payment gateways themselves, the concept of UX still seems to elude the banks. However, the interfaces for the ones facilitated by PayCorp are tolerable. Again, PayHere and WEBXPAY score the top marks here. PayHere’s UI is even customizable as per the merchant’s branding and colors.

Setup time. Speaking to the banks Sampath Bank stated it would estimate their IPG to be set up within 2 weeks. Seylan Bank says 1 week, Commercial Bank 2 days, and HNB within 24 hours. However, do note that this is assuming that all the necessary documentation is in order and approved accordingly in the first place.

Internet Payment Gateways: What’s best?

Going by the cost alone, WEBXPAY seems to be the cheapest option of the payment gateways available. But if you’re specifically looking at banks, then your best bet is Seylan. The only downside on this front is that Seylan Bank usually requires you to put in LKR 300,000 as a security deposit. Although this deposit is refundable after 1 year.

The fastest and cheapest one to start off with would be PayHere as it has no setup fees and the actual setting up process is pretty straightforward. Longterm, PayHere, WEBXPAY, and Seylan Bank are all valid choices for their low recurring fees.

Taking everything into account, it’s clear that WEBXPAY, PayHere, and Seylan Bank are the clear front runners. The 1-week setup time and the LKR 300,000 deposit may make the other two options more feasible for you.

Regardless, it’s advisable to do more research prior to making a decision to go ahead with your Internet Payment Gateway requirements. We hope this updated list helps you in making that decision.

Do let us know if we missed anything important. We’ll be updating this article if anything turns up. Until next time.

Update [06/09/2019]

A few concerns have been raised regarding WEBXPAY’s compliance with CBSL regulations. The article has been updated following our repeated attempts to verify the same with CBSL and HNB. Once we receive confirmation of compliance, the article will be updated accordingly.

Update [01/10/2019]

The section under Overall User Experience has been edited to reflect PayHere’s updated UI.

Update [09/10/2019]

We have received confirmation of the processes adopted by WEBXPAY to be in compliance with CBSL regulations. This is due to its partnership with HNB, which under “Payment Settlement Direction No.1 of 2018” is the governing Licensed Financial Acquirer of WEBXPAY. Therefore, the article has been updated.

Update [11/02/2020]

Commercial Bank has updated the prices and upgraded its IPG services. The bank is also offering additional alternative options for businesses to accept digital payments. Click here to learn more about the latest offerings from Commercial Bank.

A lot of eCommerce start-ups are having difficulty obtaining an IPG from a bank due to tight restrictions. We need a flexible IPG service where even individuals can accept a credit card payment over the internet.