Recently, the Finance Ministry announced that the government has pushed the deadline for some of the announced tax changes by one month. Accordingly, individuals now have until February 1 for vehicle registration, revenue licenses, and property purchases without a tax file. As of now, individuals 18 years or older and residents of Sri Lanka starting January 1, 2024 are to be registered with the Inland Revenue Department. Registering for taxes and obtaining a Tax Identification Number (TIN) was made mandatory following the 2024 budget reading. So what does that mean for you? Here’s what you need to know.

Why do I need to register for taxes?

Registering with the Inland Revenue Department will give you a unique TIN. As per the 2024 budget, a Tax Identification Number is mandatory for:

- Opening a bank current account

- Obtaining approval for a building plan

- Registering a motor vehicle and renewing a license

- Registering a land or a title to a land

Further, failure to register will risk a penalty of up to LKR 50,000 in fines.

Will I have to pay income tax once I register?

While obtaining a TIN is mandatory, only individuals who earn over LKR 1.2 million annually (April 1 to March 31 assessment period) will be liable for income tax. In other words, it will apply to individuals with over a monthly income of LKR 100,000.

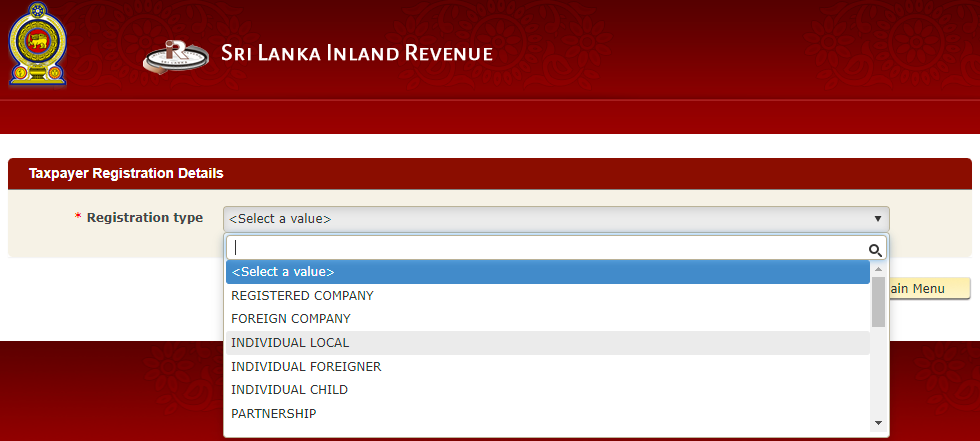

Can I register online?

Yes, via the Inland Revenue Department’s e-service portal or navigate to www.ird.gov.lk -> e-Services -> Access to e-Services -> Taxpayer Registration. It’s worth noting that at the time of writing, the IRD website doesn’t have an active SSL certificate. However, the actual e-service portal does come with an SSL certificate.

Nevertheless, as per the IRD, you would also need to submit PDF versions (scanned) of supporting documentation to obtain a TIN:

- NIC or valid passport (foreign nationals)

- Utility bill/bank account statement/passbook/ grama niladhari certificate (if the address is different from NIC) or other relevant proof of local address for foreigners

- Business Registration Certificate if a Proprietorship is to be added

Alternatively, you can register via post. Prospective applicants can download a form from the IRD site or your nearest IRD office. Once you mail in your form with the supporting documents to the following address, a TIN will be sent by post.

COMMISSIONER GENERAL

INLAND REVENUE DEPARTMENT

SIR CHITTAMPALAM A GARDINER MAWATHA,

COLOMBO 02

I already have a TIN

The IRD doesn’t offer specifics on the need for a new TIN for individuals who are already registered. Rather, the IRD states that the information submitted on file should be up to date, particularly the email and phone number.

For more details, you can find a full taxpayer guideline for registration and updates here.

Aiming for LKR 3 billion

During the budget 2024 reading, President Ranil Wickremesinghe stated that the government aims to increase tax revenue by 47% to LKR 3,820 billion in 2024, compared to last year. One of the biggest bottlenecks to this appeared to be the issues with IRD’s RAMIS system itself. However, by September 2023 the system reportedly underwent upgrades as per Acting Finance Minister Shehan Semasinghe.

It remains to be seen how the mandatory tax registration requirement will play out in the coming year, specifically when it comes to its tax revenue target for 2024. It’s estimated that income tax will rise by 25% to LKR 1,080 billion from 2023’s estimated LKR 864 billion.

Hi. We are elderly parents, receiving a donation from my son overseas for our mediation, house rent, bills and house expenses. We have no assets, only a grave yard, already take over by the government . So, do I still need to to register for the golden TIN?

Do I need to get a TIN if I am a resident / working abroad or is this something I need to do once I am back in Sri Lanka

Technically, yes if you’re a resident. But the IRD hasn’t been clear on the specifics and the online filing system doesn’t seem to offer an option for Sri Lankans overseas at the moment. But best to check with the IRD directly to be sure.

I live overseas but have dual citizenship.(Sri Lanka and United Kingdom)

I don’t have a NIC number and on my srilankan pass port it shows as NONICxxxxxxx under NIC.

In this situation should I enter the srilankan passport number? Under the NIC on the form to apply

I believe so, though the IRD hasn’t been too clear about Sri Lankans living overseas. Best check with them directly

Do I still have to register even if I don’t earn anything at all? It’s asking for a source of income, I don’t have any.

Yes, you would need to have a TIN either way

How to register with this pension people.

When i enter my NIC it says ” Invalid Reference No. ” please help

my NIC is 662750454V

0770715055