Nations Trust Bank recently made the local headlines by launching their Open API Banking Platform. As the name suggests, developers can now build apps that utilize the systems of Nations Trust Bank to accept payments and manage finances. To make sense of all of this, we first need to ask a very important question.

What is an API?

Think of it as a bunch of tools that you use when developing software. Without going through all the trouble of coding your application, you can simply use an API, cutting down on both development time and cost.

The biggest thing about the Open API Banking Platform of Nations Trust Bank is that it’s open to anyone to use. So you can be a startup, SME, independent developer, a large corporation, or just a techie playing around. Anyone can use these APIs. With it, you can carry out tasks such as ERP automation, cash flow management, and white label services.

More importantly, the Open API Banking System can be used for electronic payments. This includes online payments, purchases, and fund transfers. The current standing of Internet Payment Gateways in Sri Lanka is horrible.

If you recall, PayHere was touted to be one such IPG, but they too ran into their fair share of problems and were shut down. They did however manage to work out their problems and relaunch again. So we clearly do need a better method to transfer funds. With Open APIs, FinTechs like PayHere would be able to deliver larger outputs with better possibilities. This in turn would improve Sri Lanka’s digital economy eco-system. In addition, with the Open API Banking System, developers can facilitate payments in their apps.

How can the Open API Banking system be used?

For example, a retailer could integrate the API to their own POS systems to allow the customer to make payments directly from their bank accounts, alleviating the need for a middleman. This, in turn, would result in lower transaction costs. If your company has a Payroll system, you can integrate the Open API Banking System with the Payroll system so that employees are paid directly. This would put an end to the lengthy process of updating the company’s systems and then informing the bank about these transactions.

Is Open Banking Safe?

According to Nations Trust Bank, it is. The Open API Banking Platform falls in line with Europe’s PSD2 standard. The Open API Banking platform has also been adopted by John Keells PLC and is been integrated into Keells Super Outlets across Sri Lanka.

By using the FriMi API, developed by Nations Trust Bank, which is a part of the Open API Banking platform, FriMi customers can pay for goods and services directly at Keells POS terminals via the FriMi app. If your FriMi mobile number and Nexus mobile number are the same, then paying for and collecting points become a lot easier as well.

How do I sign up for Nations Trust Open API Banking?

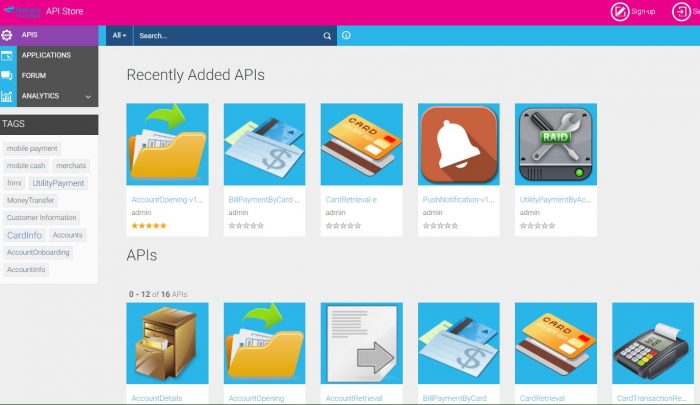

All you have to do is to click this link. From there, you would have access to all the APIs developed by Nations Trust Bank that falls under the Open API Banking platform. Each API has its own Production and Sandbox URL, documentation, SDKs and their own forum to discuss updates or issues you might be having.

Once signed in, you will have full access to a library of tools and sample code as well. From there, you can explore the code in a sandbox before testing it out and validating it with real-world data. Once all the validations are in place, you can go live with your integration and then continuously expand and innovate with your product.

A step in the right direction by Nations Trust Bank

Overall, the Open API Banking Platform by Nations Trust Bank does have a multitude of applications. Businesses such as corporates can integrate their ERP and other applications using the API to streamline and automate their business processes. SMEs and startups can make use of the API to process payments and other financial elements.

If more banks and organizations can actually open up their systems via Open API Banking, it would open up a world of opportunities. This is indeed a step in the right direction. Looks like interesting times are indeed ahead.

GIPHY App Key not set. Please check settings