When it first launched in 2016, everyone was excited. Finally, a user-friendly payment gateway that didn’t cost an arm and a leg. For a moment, we all thought that we took one step forward to solve our e-commerce woes. But three short months later, it disappeared. Now, after a year of silence, PayHere is back.

What is PayHere?

Originally launched in 2016, PayHere is a locally built online payment gateway. Its founder Dhanika Perera saw that businesses had trouble accepting online payments. These problems could be summarized as, “Limited options from the banks that were extremely costly and horrible to use.” While the government spoke of solutions, none of them were implemented.

Seeing this, Dhanika and his team decided to offer a local solution to the problem. When they first launched it, PayHere was a breath of fresh air for everyone. Unlike the options offered by the banks, there were no costly setup or annual fees.

It was free to setup and use with a small transaction fee. As such, it seemingly solved many of the problems that plagued existing online payment options. Alas, after three months, PayHere was forced to shut down.

Why was PayHere shut down?

During the three months, PayHere was in operation, it served over 100 merchants. They had shown that it was easy to build the technical solutions to solve the problems with online payments. However, they learned the hard way that the Payment & Settlement Systems Act had some clauses avoiding a third party accepting a payment on behalf of a merchant.

As such, PayHere had to stop operations until they were able to comply with these regulations. However, becoming fully compliant with the regulations was a struggle. Ultimately, it wasn’t until October 2017 when PayHere partnered with Sampath Bank, that they found a solution to their problems.

Speaking to ReadMe, Dhanika Perera – Founder of PayHere described this partnership saying, “From the day we had to stop, they were so helpful to us. Because of that, we didn’t want to approach other banks. Sampath gave extraordinary support to us legally, technically and operationally.”

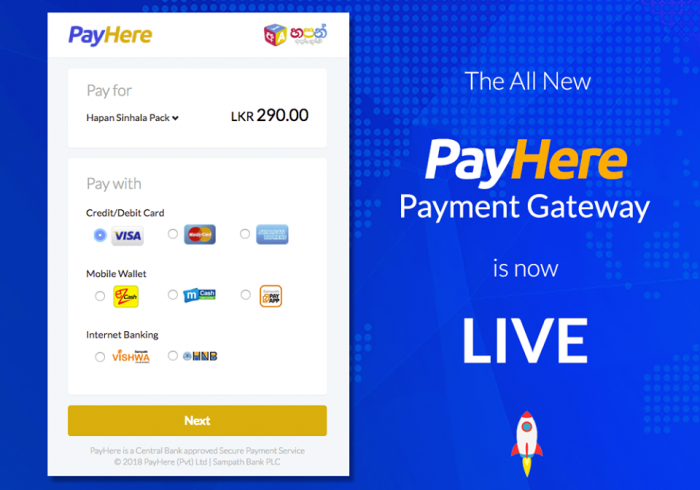

Following the approval of this partnership by the Central Bank of Sri Lanka, PayHere was permitted to resume operations. But it would take a few additional months to ensure PayHere was 100% compliant with regulations and with Sampath Banks systems. Finally, on the 1st of March 2018, after a lengthy struggle, PayHere officially resumed operations. Thus, it is now the first non-bank Internet Payment Gateway (IPG) service in Sri Lanka.

Is there anything new?

Of course, while the PayHere team was working towards being compliant with regulations, they were also working towards improving the services. Firstly, with the Sampath Bank partnership, the service now offers bank-level security. This is in addition to its original security measures, which are followed by Visa, MasterCard, and American Express.

Secondly, they’ve also introduced a second subscription option. Previously, they only had one subscription model, which was to pay Rs. 30 + 3.3% per successful transaction. Now, PayHere has introduced a second monthly subscription option where you pay 2.9% per transaction + Rs. 2900 per month.

Explaining these subscriptions, Dhanika said, “The first option is aimed at startups and businesses that deal with few but expensive payments. Whereas the second option is aimed at businesses that deal with small amounts on a regular basis.” Yet one of the biggest changes is regarding the process of merchants receiving money through the payment gateway.

Previously, there was a fee of Rs. 200 for a business to receive money from the service. But now the pay-out fee has been eliminated. As such, the money will be deposited into the bank account of the business at the end of the day. The only catch is that your business will need a bank account at Sampath Bank.

Cutting through the red tape

At the end of the day, PayHere’s return signals a welcome sign for the local e-commerce industry. It’s a step forward in the right direction. Granted, there is still a long way to go. Nonetheless, this is much-needed progress.

And this step forward also shows us that despite technical and regulatory barriers, startups can solve big problems. But, it shouldn’t have been this hard in the first place.

If you’re interested in PayHere, then click here to know more about them.

GIPHY App Key not set. Please check settings