In 1976, the Computer Society of Sri Lanka was formed. Among its founding members was a lady. This lady is one who stands tall amongst the silent giants of the Sri Lankan IT industry. Over the course of her career, she helped build complex computer systems that revolutionized the Sri Lankan banking system. This iron lady is Nayeni Fernando, and this is her story on how she, together with her team revolutionized the banking systems of Sri Lanka and Bangladesh.

From Humble Origins

Nayeni began her journey into the world of computing in 1971 when she joined the Department of Census and Statistics as an analyst programmer. However, she like the other four people that got the job, didn’t know anything about actual computer programming. As such, Nayeni and her four new colleagues were sent every morning to IBM.

It was at IBM they got training in Report Program Generator (RPG), which was a programming language used by the IBM System 360. This IBM computer had a tape-operated machine with only 24 KB of RAM. Nayeni and her colleagues used this computer to program the data for the Sample Census of Sri Lanka in 1970.

At first, this was a brand new adventure for her, but after 8 years it had become routine for Nayeni. She was bored and itching for a change. That’s when she saw an advertisement and joined the Central Bank of Sri Lanka in 1979. This was where her career would begin to reach for the stars.

Welcome to the Central Bank

When Nayeni joined the Central Bank of Sri Lanka in 1979, she was its first female analyst programmer. Furthermore, she was also the first Analyst Programmer to join the Data Processing Division of the Central Bank from outside the Central Bank of Sri Lanka. The Division at the time was headed by Dr. K.S.E.Jayatilleke Director of the Statistics Department of the Central Bank. This data processing division like in many other organizations was the predecessor to the modern IT department.

As soon as Nayeni joined the Central Bank, she was assigned to the team tasked with programming the Socio-Economic Survey of the Central Bank with a similar IBM System 360 that used RPG and RPG2 programming language. Following the preparation of the Socio-Economic Survey, Nayeni was tasked with computerizing the Government’s Accounts Branch of the Central Bank. This was a department that had to process an endless number of cheques and on a typical day, the process would end past 8 PM. Nayeni built an automated system using Wang PCS II data entry machines. Then with the help of three enthusiastic young staff and Mr. Hamid – Head of the Government Accounts Branch, Nayeni was able to implement the system, which was her first major project.

Building the Sri Lanka Automated Clearing House

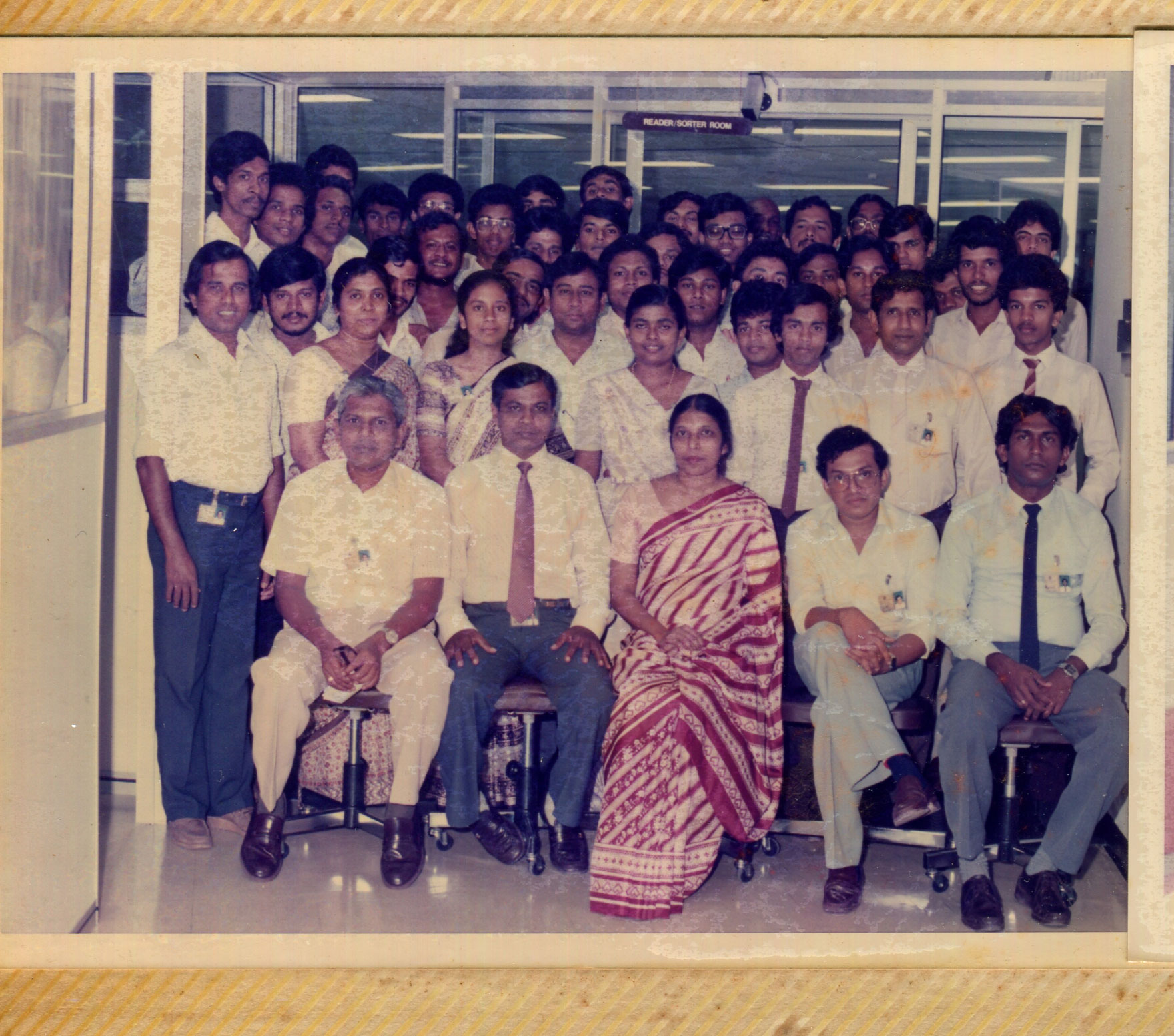

When Nayeni returned to Sri Lanka in 1985 after obtaining her master’s in the US, she was asked to build the Sri Lanka Automated Clearing House for the Central Bank. This clearinghouse was the primary objective of then Governor of the Central Bank in 1985 – Warnasena Rasaputra. For a project this big, Nayeni needed a strong team. Thankfully she was able to find the right people for this team.

This team had two operations managers: Justin Wickramasinghe & P.U. Ariyawansa along with two analyst programmers: Chandra Pathberiya & B.K.A. Sunimal. However, even with this strong team Nayeni and her team knew little about building a clearinghouse. She shared her concerns with the governor. He replied by telling her, “Go to Singapore tomorrow.”

Before they knew it, Nayeni and her team were on a flight to Singapore. There they learned everything they needed from the Singapore Clearing House. Once the team was trained, a tender for the system was then announced in 1986 and given to Unisys through their agent BC Computers. Work then began on building the system that would power the Sri Lanka Automated Clearing House.

Over the course of this project, Nayeni and the team traveled twice to Atlanta where the main offices of Unisys were located. The first time was for technical training. The second time was for pre-acceptance testing where she was accompanied by the operations manager Justin Wickremasinghe and the Head of Department Mr. P. Amerasinghe. After more rigorous testing, the Sri Lanka Automated Clearing House (SLACH) was born on the 2nd of March 1988, and Nayeni was appointed as the Manager of the SLACH.

Guiding the Central Bank through its darkest times

In 1994, Nayeni was promoted as Head of the IT Department after she had successfully implemented the Sri Lanka Interbank Payment System in 1993. The decision was taken as the management decided that they needed someone with a strong background in IT. Little did she know that this new responsibility would see her guiding the Central Bank of Sri Lanka through its darkest times.

On the morning of the 31st of January 1996, Nayeni reported to work as usual. It was a normal day but this normal day would soon be remembered as one of the darkest days in Sri Lankan history. As Nayeni was seated at her desk she suddenly heard gunshots. She walked out of her room and spoke with the two floor officers. The three of them decided to inspect the fire exit in case of an emergency.

And then the worst happened. As Nayeni and the floor officers got onto the fire exit, a lorry full of explosives arrived at the entrance to the Central bank. The wheel of the lorry got caught in the flower trough at the entrance. The bomber then decided to explode the bomb just at the entrance and not under the porch, thus preventing the whole building from collapsing with 700 or more employees inside. Black smoke started filling the air and the door between the office and the fire exit slammed shut. Nayeni and the two officers were uninjured and went down using the fire exit and gathered behind the then Intercontinental Hotel. This incident would be remembered as the Central Bank bombing.

The blast killed at least 91 people (41 from the Central bank) and injured 1,400 others. This attack along with another bombing in July the same year caused tourism to plummet 40% in Sri Lanka. Yet that wasn’t the only damage to the economy the LTTE had done. The mainframe computers at the Central Bank of Sri Lanka had gone up in flames. In other words, the IT department had been destroyed.

It was crucial that these computer systems became operational again as soon as possible. The very next morning, Amarananda Jayawardena – the Governor of the Central Bank in 1996 instructed Nayeni to rebuild the IT department. It was a daunting task but thankfully: they already had backups of the latest data. However, just because they had the data didn’t mean that everything went smoothly. This was a time before standards like USB meant easy data transfers between computer systems.

To rebuild the IT department, Nayeni had gathered the key people in her department along with Dr. R.B. Ekanayake – Chief of IT at Commercial Bank and John Fernando – Head of IBM in Sri Lanka. They had a lengthy discussion and ultimately decided to adopt the IBM AS400 System to rebuild the Central Bank IT Department. However, the AS400 couldn’t read the data tapes that held the backups. Nayeni and her team visited various IBM installations with Computer Systems similar to the one that the Central bank had, but none of them could read these data tapes.

When all hope seemed lost, John Fernando gave Nayeni a call and told her that he would obtain used IBM machines identical to what they had previously used to get the data on the tapes ready for migration to the AS400. Now she needed a place to carry out the rebuilding process. Thankfully, after speaking with Prof. V.K. Samaranayake, she was able to get to the first floor of the University of Colombo Physical Science Department. All she needed to do now was to obtain funding to pay the rent for the computers and the location.

When Nayeni went to Amarananda Jayawardena asking for Rs. 90,000 rent per month. She was told it wasn’t possible at a time when he had to rebuild the whole Central Bank. Nayeni replied by saying, “Governor, there will come a day when the people of this country will demand answers as to why their EPF is not being paid. They will write letters to the President. These letters will eventually be redirected to you from the President and you shall have to give an answer.” Needless to say, it wasn’t long before Nayeni got the money she needed.

With the money, machines, and a location secured the migration process could now begin. Once the machines were installed inside the University of Colombo, the operators would walk in every morning and begin processing the tapes until the sun had set in the evening. Even though they now had computers that could read the data tapes, it was still a daunting task because all the documentation was lost in the Central Bank bomb blast.

Furthermore, the system had to now be redesigned for the new AS400 computer systems. With no documentation, Nayeni entrusted the task to N.M. Jayasekera – Deputy Director of the IT Department at the Central Bank. He was a member of the team that was responsible for building the original EPF system. Thus, he knew the entire system like the back of his hand. So Jayasekera, along with Janaki Manampitiya and Chandra Pathberiya, began working on redesigning the EPF system for the AS400.

As with the other tasks entrusted to the IT department, this too was no easy task. When the AS400 machines arrived, they were placed in the basement of the Central Bank office in Rajagiriya. This was where the trio would call their second home as they built the new systems. Every day they would go to work, sit on their chairs, and keep the keyboard on their laps as they coded the new programs as there was insufficient space in the room where the computers were.

Many months of hard work later, in August 1996, the AS400 computers were moved into the temporary office of the Central Bank at the World Trade Centre. When they went live, the banking system resumed normal operations once again. Six months after the Central Bank Bomb Blast, Nayeni and her team had rebuilt the entire IT infrastructure of the Central Bank from scratch.

Bringing the banking system of Bangladesh into the 21st century

In 2000, Nayeni took the decision to retire from the Central Bank of Sri Lanka to focus on her family and a less stressful job. She joined the Bank of Ceylon as an IT consultant. Later, Nayeni joined BC Computers. They were trying to win the tender for the system that would power Bangladesh Automated Clearing House in 2004. Alas, they were disqualified in favor of a local party, which they were told had more experience.

However, a few months later, one of the International Consultants who was present at the Tender Evaluation and heard Nayeni as she presented the BC Computer’s proposal for building the Bangladesh Clearing House reached out to Nayeni asking her to be a consultant working as the onsite project manager for implementation of the project. She then spoke with Sunil Wijesinghe – Managing Director and Priyanka Perera – Deputy Managing Director of BC Computers. Both of them encouraged her to take the opportunity.

Soon, Nayeni was on a plane to Bangladesh. When she arrived, she was tasked with building an Automated Clearing House and another system to facilitate electronic fund transfers between banks. The project faced an uphill battle for two main reasons. The first was the non-existence of MICR cheques. The second issue the project faced was that many of the Commercial Banks used predominantly manual procedures.

To solve these issues, the Central Bank of Bangladesh took matters into its own hands. It began supervising the issuance of MICR cheques and monitoring their circulation. At the same time, they also sent a team of five employees from the Central Bank of Bangladesh who were specially chosen for this project to automated clearing houses in Asia, including Sri Lanka and the Middle East for rigorous training to implement and manage these systems.

Afterward, the banks were given the necessary software and specifications for the required hardware for both systems. Testing then began at the Central Bank of Bangladesh and at the other banks. Once the tests were done, the systems would go live. The first was on the 7th of October 2010, when the Bangladesh Automated Clearing House was born. Cheque images were processed with the physical cheque remaining at the bank in which it was deposited. Four months later, on the 28th of February 2011, the Bangladesh Electronic Funds Transfer Network went live.

Commenting on the success of this project Nayeni told us, “They were woefully behind us at first. In 2008, they didn’t have MICR cheques, which we had for decades. The computer room in one Commercial bank even had mice and water running through it. However, in just two short years they surpassed us with this project. This was also the first major computing project that the Central Bank of Bangladesh completed.”

Nayeni Fernando today

From humble beginnings at the Department of Census and Statistics to the Central Bank of Sri Lanka. She joined the Central Bank as its first female analyst programmer and left as the first female head of the IT department. In that time she automated departments, built the Sri Lanka Automated Clearing House, built the Sri Lanka Interbank Payment Systems, and rebuilt the Central Bank’s IT department from scratch.

Over the course of her career, Nayeni revolutionized the Sri Lankan banking sector by building systems that many of us take for granted today. And that’s before she helped the same revolution take place in Bangladesh in just two short years. It is beyond the shadow of a doubt that Nayeni Fernando is among the pioneers that helped build the Sri Lankan IT industry. So what challenges is she focused on now? After working from 1969 to 2017 she is taking a break at the moment but will work again if the right opportunity comes by.

GIPHY App Key not set. Please check settings