A few weeks ago Bhasha unveiled its latest product/feature, HelaPay. Since then adoption has been going quite well for the company. In fact, there were over 1,000 transactions via HelaPay within a span of five days after launch. So how is it really? Is using HelaPay actually worth it? Here’s a closer look.

Wait, what’s HelaPay again?

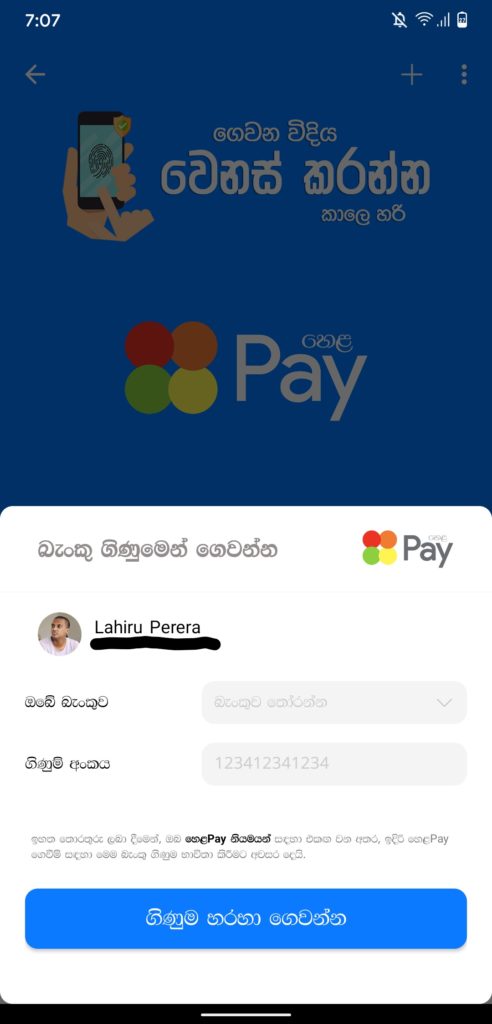

In case you missed the announcement, HelaPay is a Sri Lankan digital wallet platform that lets you make payments via biometrics, that is, fingerprint or face ID. Although platforms like Google Pay had this feature since 2019, HelaPay is the first to offer such a feature for the Sri Lankan market.

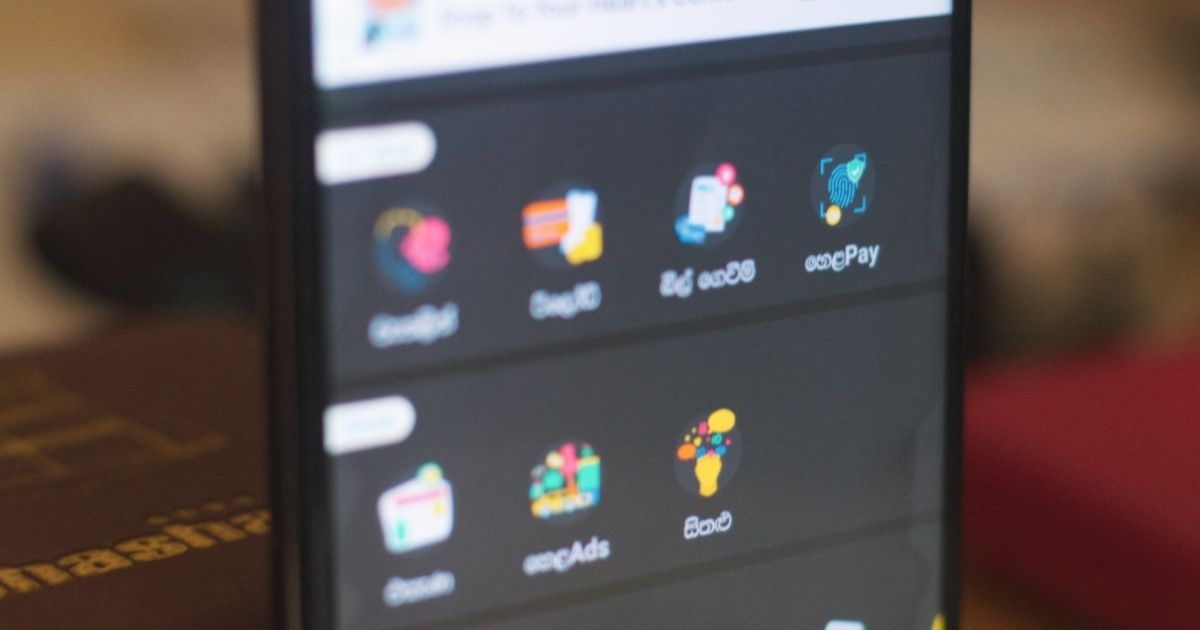

To top things off, it leverages Bhasha’s existing popular products. This means that for the user, the interface is integrated into the Helakuru app itself. Meanwhile, the client-side is embedded with its PayHere IPG.

Paying with your fingerprint

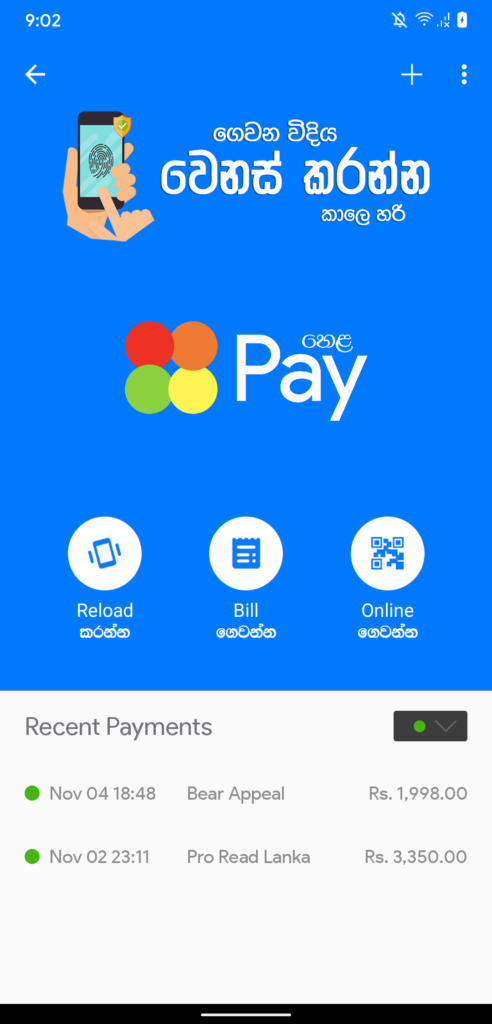

Okay, back to the app. Signing up for HelaPay is pretty straightforward. All you need to do is go to the Helakuru app and look for the option under “Services”. Next, you add your bank details. Once verified, you’re all set up. If you were wondering, yes you can add more than one bank.

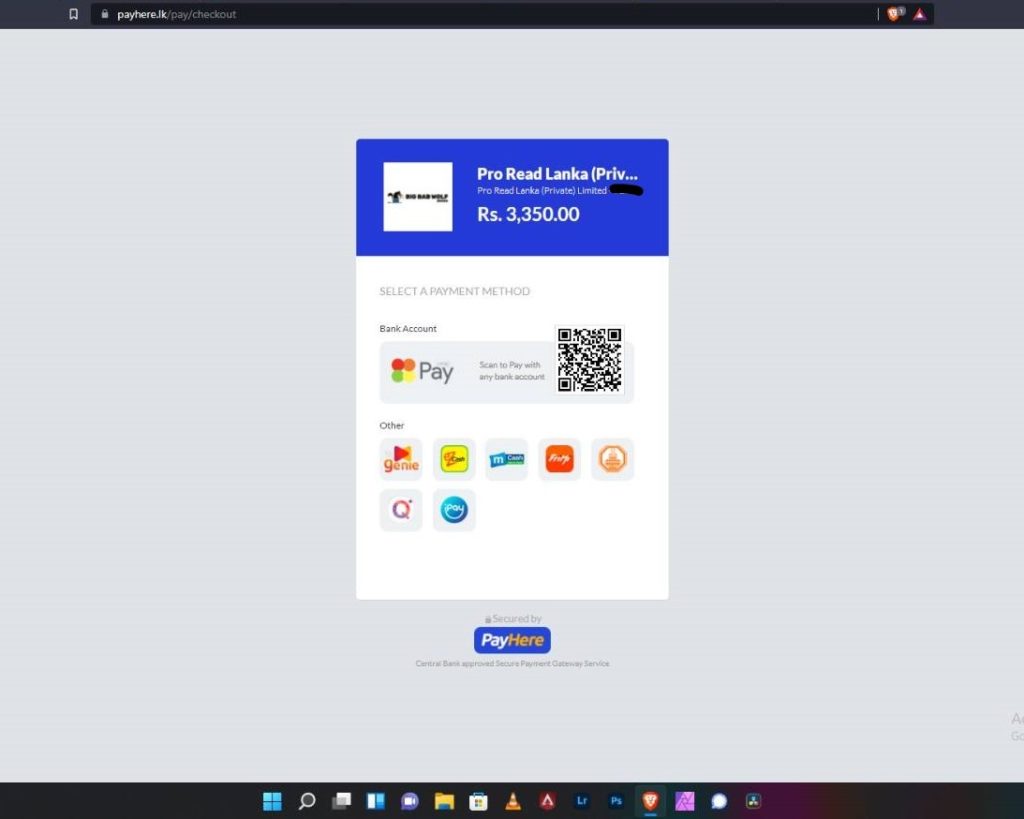

I tried HelaPay on the PC while I was doing my Big Bad Wolf shopping. After the familiar payment gateway page popped up, I scanned the included QR code through the Helakuru app’s HelaPay option. Afterward, the app prompts a fingerprint or face ID input. Do note these are biometrics you would have already assigned to your phone. Less than three seconds later, I was done already.

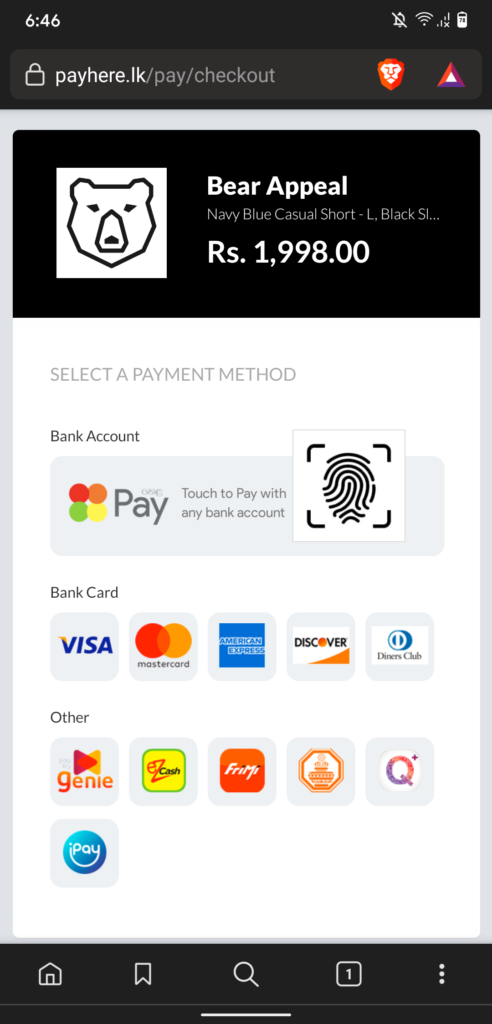

It’s a similarly smooth experience on mobile as well. Here, instead of the QR code, you’re redirected to the Helakuru app from the main payment gateway page. Though my first attempt sent me to the Helakuru app Play Store page even though the app was already installed.

The pros

The process definitely saves you a few minutes. There’s no need of dealing with your card details or OTPs. It gets even easier if you’re someone who deals with multiple bank accounts. Yes, it was quite the godayata magic moment and now I wish I could do every transaction with my fingerprint.

One added nice touch is the record of past transactions, both approved and declined/failed on the HelaPay page. It’s a small, but useful addon that helps keep track of your transactions easily.

The cons

There’s really nothing much to complain about, not even the UI. One nitpick I do have is how bill payments or reloads are attributed separately compared to other forms of payment. Ideally, I would have preferred every form of HelaPay transaction in one specific section on the Helakuru app.

Then there’s the fact that HelaPay is confined into Bhasha’s ecosystem. Even if you’re among the millions who have the Helakuru app, you still need PayHere from the seller’s side for it to work. On the other hand, there are over 3,000 businesses that employ the service. So you’re only restricted if your particular online store isn’t included in the list.

An enticing future for Sri Lankan fintech?

Speaking of which, it would be interesting to see how other payment providers react to HelaPay. It won’t be surprising to see banks introduce their own biometrics payment solutions to existing products and services. There are already a plethora of QR-enabled payment apps in the local market.

Nevertheless, it would be quite something if the Helakuru app’s HelaPay opens up for other IPGs in the country. I asked Bhasha’s CEO Dhanika Perera if there’s a possibility of this happening. For the moment, it looks like the feature will be retained exclusively as an internal feature. Though one can see why that’s the case. Leveraging the power of its existing platforms is part of HelaPay’s appeal. Opening it up to third parties means Bhasha will lose some of that appeal.

From a broader perspective, the likes of HelaPay offer a glimpse of the opportunities that contactless payment solutions have for a market like Sri Lanka. From large-scale projects like LankaQR to public transport solutions, there’s potential for contactless payments to make their mark. Though we may be months, if not years away from it becoming the norm.

For now, HelaPay gains a top spot as one of the most convenient payment solutions in Sri Lanka. It may be a simple feature. But it’s one that offers the perfect balance between a good user experience and security. An aspect that’s critically underrated for any digital product today.